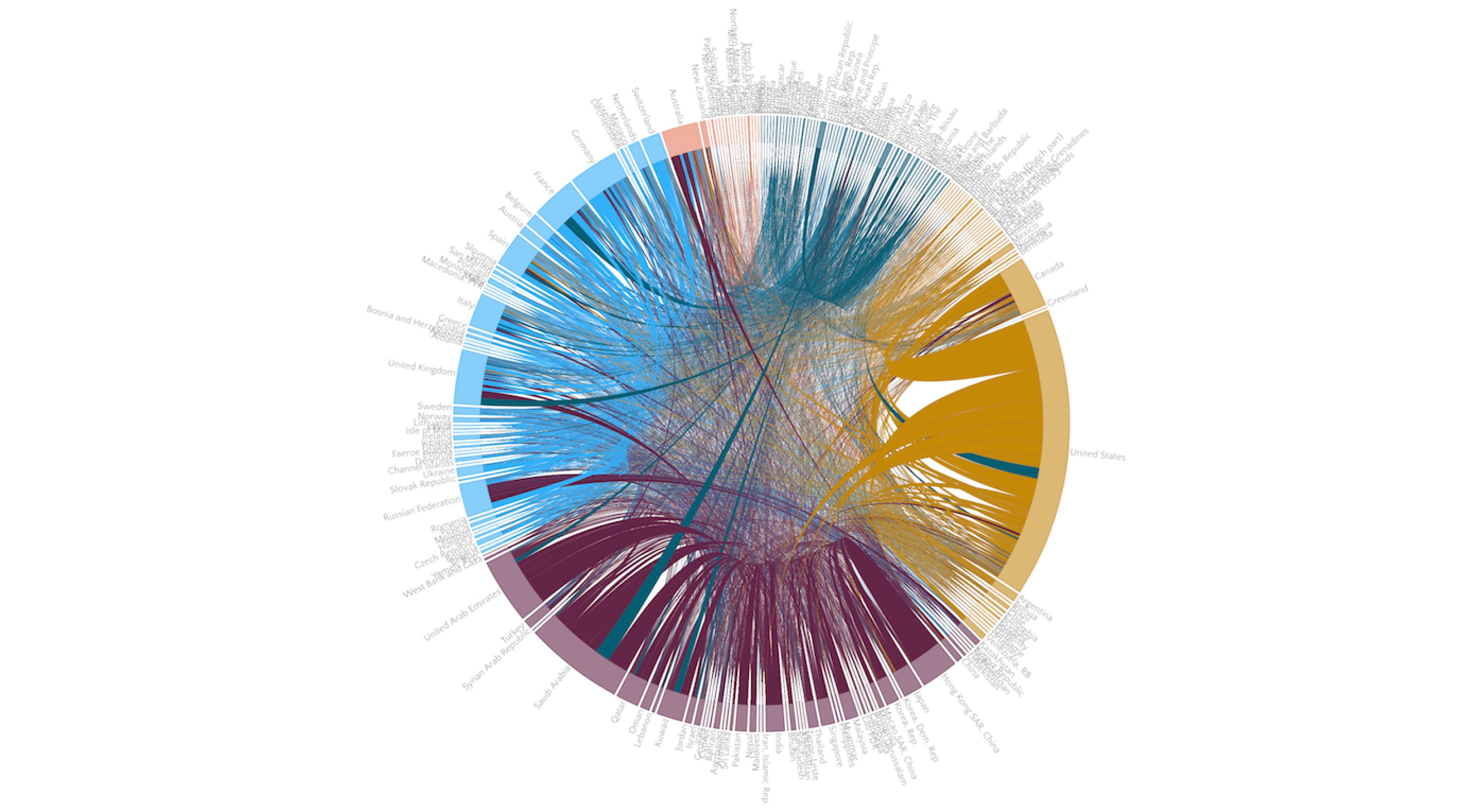

$582 billion in global remittances: interactive graph

Remittances in 2015 totaled an estimated $582 billion according to World Bank figures. These cross-border payments make a huge impact in the countries that receive them. World Bank figures show that in 2015, remittances to Egypt were worth four times as much as revenues from the Suez Canal. In Nepal they make up nearly one-third of total GDP. And Trump's recent threat to tax remittances to Mexico caused significant anxiety among those initiating one of the world's largest remittance flows.

Fintech is expected to revolutionise these remittance payments by significantly reducing transactional costs, making it easier and improving transparency and speed.

At $500 billion, every percentage point saved puts another $5 billion into the pockets the migrants and their families. A significant amount by any standard, by especially for migrants.

Flash Payments just launched its highly anticipated lean high-performance foreign exchange transfer payment service that safely, efficiently and reliably provides users with a better customer experience compared to the opaque, siloed and inefficient banking networks.

Built on a common global infrastructure and bringing new efficiencies to financial remittances, by enabling near real-time settlements, improving visibility and reducing risk, Flash Payments delivers tangible advantages from both a technical and financial perspective.

Based in Sydney Australia, Flash Payments is a cutting edge fin-tech startup engineered from the ground up to deliver intelligent foreign exchange transfer services, of course without hidden fees.

Using the innovative Ripple technology platform and XRP, Ripple's digital currency, Flash Payments delivers extraordinary transparency, speed and transactional control to users.

Flash Payments provides a lean high-performance foreign exchange transfer payment services that safely, efficiently and reliably provides users with a better customer experience.

The technology tightly integrates payments messaging with funds settlements, allowing for unprecedented visibility and performance.

Unlike the banks, Flash Payments puts their customers in control. They can choose a target conversion rate, automate the international money transfer and track their currency transfer, like a package, from start to finish.

Learn more about Flash Payments and sign up to benefit from their cutting-edge technology, great rates, transparency and control.