Flash Payments | A Better Way to Send Money to India

Affordable, secure and hassle-free money transfers to India are now available with Flash Payments.

Flash Payments is excited to announce that we now support international money transfers from Australia to India. Sending money to family and friends back home just got a lot more affordable.

Read on to learn how Flash Payments can help you maximise the amount of money you send to India.

Why Flash Payments

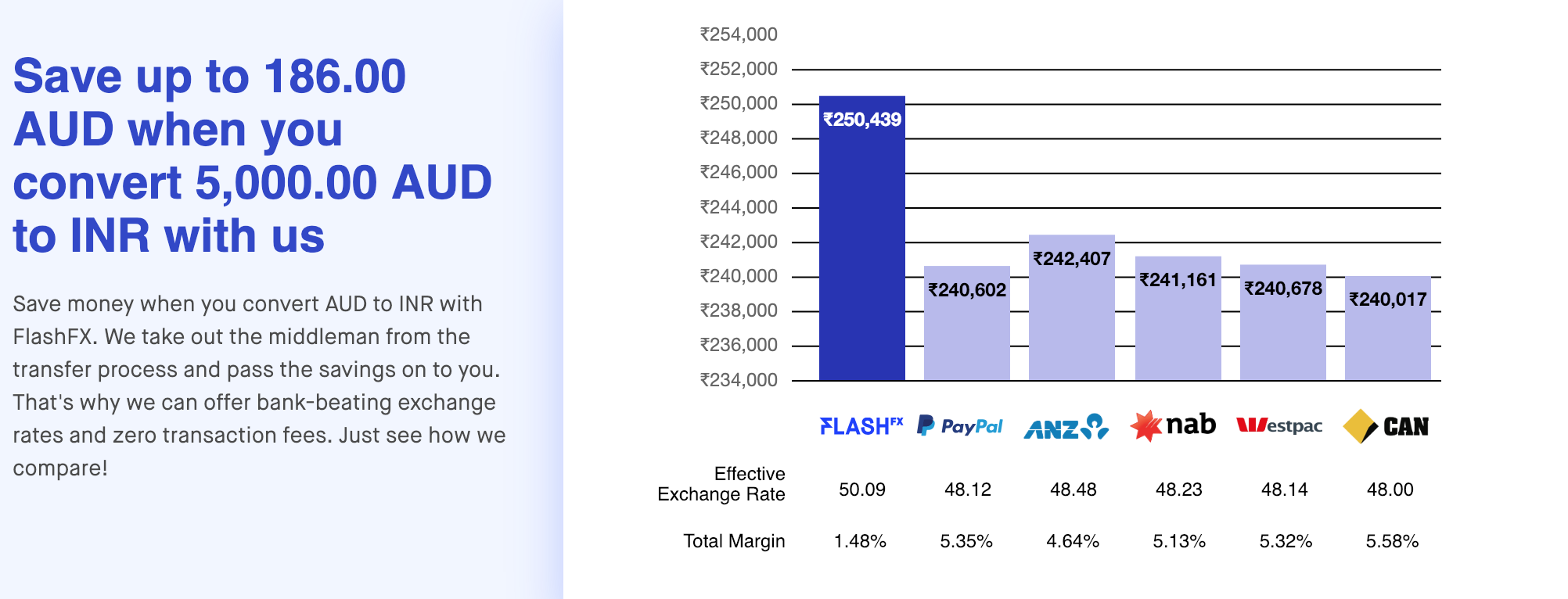

- Fair, transparent exchange rates that will always offer better value than the banks

- Zero transaction fees

- Speedy transfer times, typically between 1-2 business days

- Real-time funds tracking

- Top-notch security (we are licensed and regulated by ASIC and AUSTRAC)

Check up-to-the-minute live AUD/INR exchange rates on our website. Our currency calculator lets you see exactly how many INR your recipient will receive if you transfer money with us.

How it Works

Built on the latest technology, and partly integrated with the distributed-ledger protocol Ripple, Flash Payments removes the middlemen from the traditional transfer process and passes on the savings to you.

That’s why we are able to offer zero transaction fees, more competitive exchange rates and speedier transfer times than other providers.

Send Money to India With Flash Payments in 3 Steps:

1. Create your account – If you are living in Australia and have an Australian bank account, it’s easy to send money to India with Flash Payments. Register your details and provide one primary ID doc, like a passport or driver’s license.

2. Send money – Once your Flash Payments account is funded, set up a transfer by inputting the recipient banking details, as well as the AUD amount you are looking to send.

3. Track your transfer – The Flash Payments dashboard lets you track your transfer in real-time. Login at any point to view your transaction history or check the status of your payment.

India Money Transfers – FAQs

Is there a limit on how much I can send to India?

No. There is no max transfer limit for either individuals or businesses. Flash Payments has a minimum transfer limit of $200 AUD per transaction.

Can I transfer money from an Indian bank account to Australia with Flash Payments?

Unfortunately, Flash Payments can only facilitate transfers from Australian bank accounts to bank accounts in India at this time.

How long will it take for my money to arrive?

Transfer times to India typically take between 1-2 business days.

What relevant banking information will I need to send money to India?

To successfully send money to India you’ll need the recipient’s banking details, including the IFCS code, as well as the bank account number. You’ll also need the recipient’s full name and address.

The IFCS is an 11-digit code that identifies specific bank branches within the National Electronic Funds Transfer (NEFT) network in India. The Reserve Bank of India uses the IFSC for electronic money transfers between banks.

Does Flash Payments accept credit card or debit card payments?

No. You can fund your Flash Payments account either through a traditional bank transfer or via PoliPay. We do not accept credit or debit card payments for transfers to India. Flash Payments also does not support cash pick-up.

Does Flash Payments have any AUD/INR exchange rate management tools?

Yes. If you are looking for a better rate to convert AUD to INR, then Flash Payments’s rate alert feature is the perfect tool. Simply enter your desired AUD/INR rate and leave the rest to us – we’ll email you once the currency has reached that level.