Market Update: The US Dollar blues explained

The biggest story in FX markets over the past few months has been the USD's dramatic decline. We look into the factors behind the move and explore whether USD weakness could continue.

The biggest story in FX markets over the past few months has been the USD’s precipitous fall from grace.

In March, when the coronavirus prompted an historic economic collapse and sent global stock markets into a freefall, investors and companies all over the world quickly rushed to convert their money into the currency they trusted above all others: the US dollar. This widespread flight to safety caused an extreme rally in the currency, similar to what we witnessed during the 2008-2009 global financial crisis.

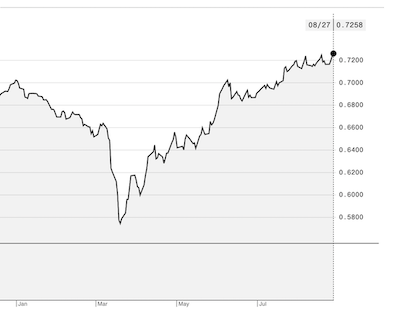

But in just a few months time the USD has experienced a severe decline, suffering its worst monthly performance in 10 years in July and hitting its lowest point against a basket of other G10 currencies since 2018.

What happened?

The catalyst for the US dollar’s reversal was the significant increase in the number of US coronavirus cases in June and July, just as European and Asian countries seemed to be getting things under control. Then, the US Federal Reserve committed to keeping interest rates at zero for the foreseeable future and embarked on aggressive balance sheet expansion policies to shore up the US economy.

Taken together, the flare-up of the virus plus lower interest rates for longer meant that investors had less demand for the US currency.

But that’s not the whole story.

It’s worthwhile exploring the historical context in which this USD reversal has occurred to better understand if and why it could continue.

Traditionally, the three biggest pools of investment capital have been Europe, Japan and the United States. These capital pools are comprised of pension money, asset manager investments and, to some extent, central bank funds. Where and how this money is allocated is typically dictated by where these investors can get the biggest yield on their investments, and over the past 10 years that has predominantly been in USDs and USD-denominated assets (stocks and bonds).

European and Japanese interest rates have been at-or-below zero for the better part of a decade, while the US has enjoyed relatively higher yields and better economic growth. But the coronavirus pandemic has brought US interest rate policy in-line with these counterparts; there is no longer a ‘yield’ advantage to owning USD assets if you are a foreign investor.

So, part of this USD decline can be explained by a larger and more structural shift of global capital flows away from the USD and US assets and into domestic ones in regions like Europe or Japan, which have largely underperformed US assets over the past few years. If nominal yields remain relatively balanced across global economies going forward, one could argue that this USD weakness trend has more room to run.

Don’t Forget November

In the background of all of this is the looming US Presidential election. Recent polls show that Democratic nominee Joe Biden has a commanding lead over President Trump, whose approval rating is suffering from voters’ dissatisfaction with his handling of the coronavirus and race relations. Political pollster FiveThiryEight – the only poll to correctly predict President Trump’s 2016 election win- currently has Biden ahead of Trump 73 points to 27. They expect this lead to widen as we approach election day in November.

Investment analysts expect a Biden presidency would be less favourable for the USD, as he is expected to reverse many of Trump’s pro-business, anti-regulation policies. But with such an entrenched lead already it is reasonable to expect much of this USD weakness is already priced in.

Where does this leave the Australian dollar?

Given the importance and size of the US economy, global investment trends will be driven by how analysts gauge the speed and strength of the US recovery relative to other major economies. AUD will largely be in the backseat for now, although expectations are that the AUD will tread between 0.7000-0.7500 USD for the next few months as the USD weakness trend persists.

One domestic story that could have a meaningful impact on the AUD should it eventuate would be if interstate borders were to reopen across Australia, particularly between New South Wales and Victoria.