What is ISO 20022 and how will it change payments?

ISO 20022 promises to modernise cross-border and real-time payments processing using data standardisation.

The International Organisation for Standardisation (ISO) describes ISO 20022 as “a multi part international standard”, “a common platform for the development of messages” and “a modelling methodology to capture in a syntax-independent way financial business areas, business transactions and associated message flows”.

Confused? You're not alone. While many people in the financial services industry have heard of ISO 20022, only a few understand what it is about and its potential impact on the global payments system.

What is ISO 20022?

ISO 20022 is all about messaging, specifically the messages banks send to each other when a cross-border transfer is made. It is aimed at standardising the messages between global financial institutions to improve the interoperability of payments.

Financial messaging provider SWIFT first published the new format in 2004, proposing that ISO 20022 (MX) replace its existing messaging standard (MT). The planned migration to ISO 20022 has taken place over many years with over 150 countries adopting the new standard so far. The transition process set to continue until 2025, with countries like Australia and the US starting their transition processes in 2024 and 2023, respectively.

Why the change?

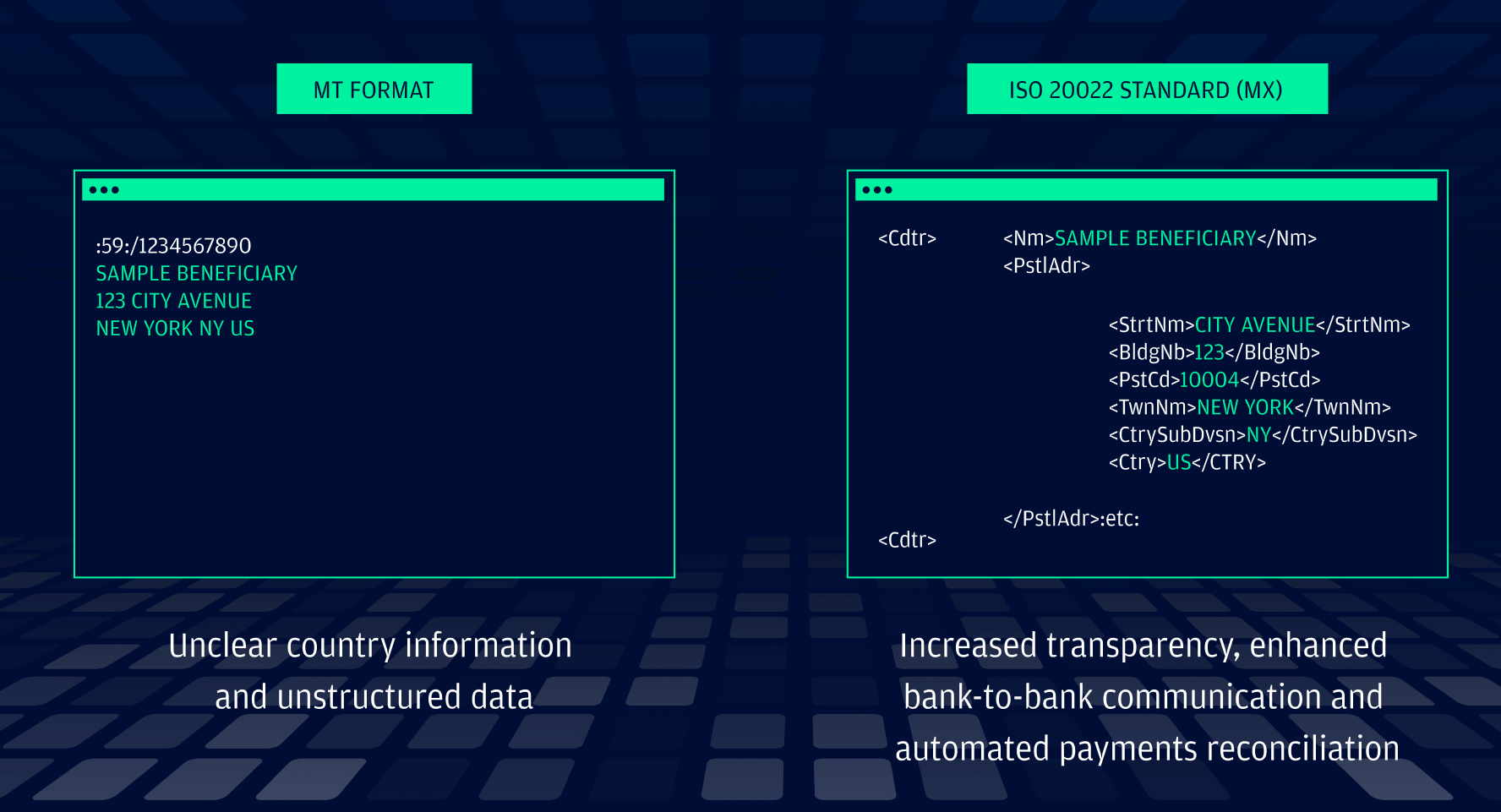

In the financial services industry, messaging standards are what make it possible for systems and networks around the world to communicate with each other. But in the current system, messaging standards for international payments are extremely patchwork and unstructured. With no over-arching regulation for what the messages should contain, and no data fields in which additional information can be included, it's extremely difficult to apply AI or other automation to process transferring money.

Source: JP Morgan

The proliferation of formats and standards has meant that payment networks and systems cannot integrate well with each other. Consumers, meanwhile, are becoming increasingly used to a digitised world and so their expectations around seamless international payments are not being met within the current model. ISO 20022 addresses both of these challenges.

Why is ISO 20022 an improvement on SWIFT?

Compared to the old SWIFT messaging system, ISO 20022 payment messages provide a much more structured, data-rich common language that is necessary for modernising cross-border and real-time payments processing. Key benefits can be broken down into a few areas:

Automation

When processing systems speak a common language the need for manual intervention or manual processing is removed. Funds flow seamlessly through the payments system, resulting in lower transaction costs and faster settlement speeds.

The standardisation of the ISO 20022 format means that it can be integrated into nearly every market infrastructure and payments system around the world. This means better analytics, fewer mistakes due to human intervention, more accurate regulatory compliance and better fraud protection.

Interoperability

A single golden standard for payments messaging removes overheads associated with translation and conversion. Payments can travel more easily between payment networks around the globe and should me that money sent from France to the Brazil can be done as easily as sending money from France to the UK.

Enhanced Customer Experience

Thanks to ISO 20022, banks have more data and information about customer behaviour and needs. The dispersement of customer information across institutions should increase competition between banks and payments companies. To remain competitive, these businesses will need to develop products customers at all levels of banking will want to use, leading to an overhaul enhanced business product for existing customers.

The promise of ISO 20022 for payments

If adopted globally on a broad scale, the ISO 20022 standard has the potential to completely transform cross-border payment processes, which at present are mired in delay, high costs, and opacity due to a lack of standardisation and a reliance on legacy systems. The new standard will allow for improved payment transaction data quality and greater interoperability between international payment schemes.

Source: Iziago

The ISO 20022 standard enables existing payments networks to transform into instant payment schemes, which would allow cross-border payment transactions to be completed within 10 seconds. The ability to utilise payments originated overseas and execute clearing in real-time domestic systems has the potential to revolutionise financial services, which has historically laboured under the outdated correspondent banking models and are increasingly unsuitable for the demands of international banking and the movement of money.

Key for the cross-border payments world is the information that ISO 20022 messages contain with the remitter details, including names, addresses and purpose of payment. This information will prove crucial for reconciliation, and should improve traceability and transparency.

Challenges remain, but the momentum is positive

The unification of global instant payment schemes is a complex process, and the project continues to face challenges with interoperability due to varying adoption rates among countries. That being said, momentum remains positive and the movement towards instant payments is expected to continue to gain traction going forward.