Open Banking Explained

Open banking initiatives have taken off in many economies around the world, including Australia. More than just a buzz word, open banking is one of the key initiatives helping to deliver better financial experiences for both consumers and merchants when it comes to payments.

What is open banking?

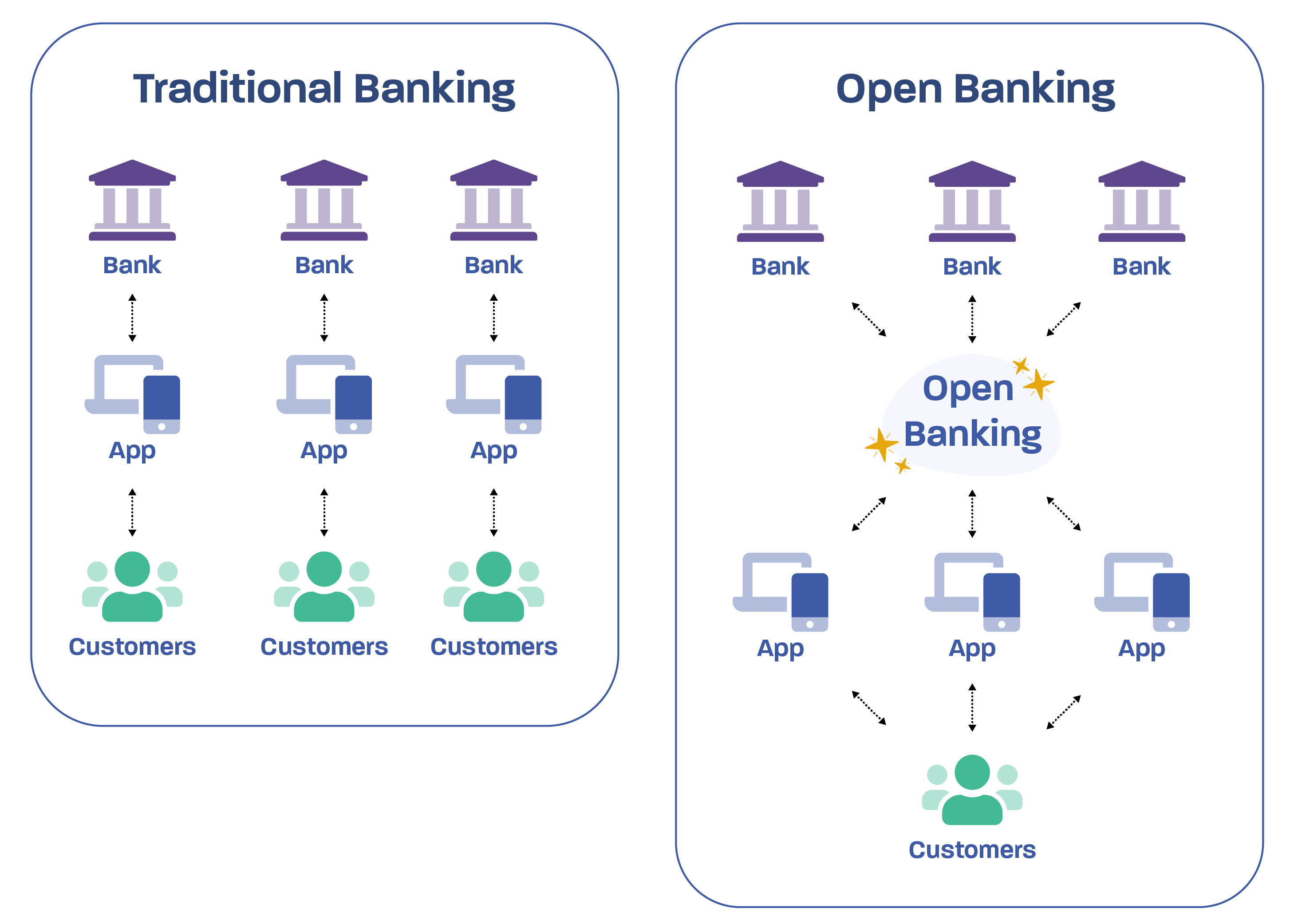

In a nutshell, open banking open banking is the process of banks and financial institutions giving customer-permissioned data to third parties. Through open banking, data that would otherwise be stuck at your bank can now be shared with other financial providers, including balances, transactions and payments. It can also include letting authorised third parties initiate transactions, make payments or withdraw money from a customer's account.

Source: Wonderful Payments

Third parties are able to access this data through APIs - or pieces of software that let applications talk together through a defined set of rules. APIs are the key to open banking, but we'll talk more about this later.

A quick history

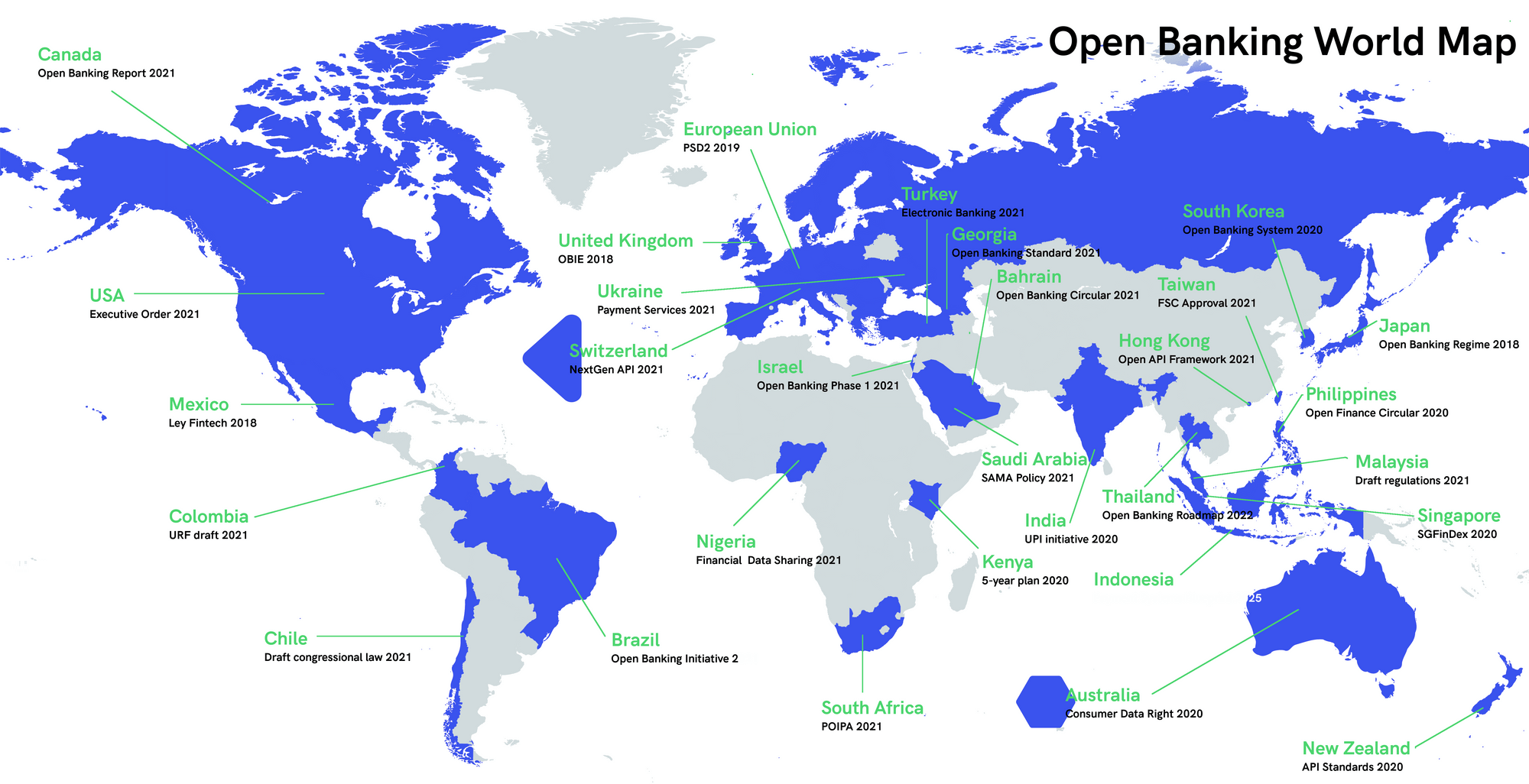

Open banking initiatives started in the 19080s but didn't gain popularity until around 2007 when the European Union created the Payment Services Directive (PSD) to regulate payment services and providers. The purpose was to lower the barriers to entry for financial technology companies and enhance consumer protection and rights.

In 2019, open banking was further regulated by the European Commission with the PSD2. PSD2 has provided a European-wide regulatory framework that allows third parties safe and secure access to either gather transaction data or initiate payments on a customers behalf (with their approval). While PSD2 did not invent open banking, it has been the catalyst for an accelerated adoption in Europe.

Today, there are many countries around the world that are working towards an open banking framework. Some are regulatory-driven, based on the PSD2 model, while others, in countries with no regulation for example, banks and fintechs are leading the charge.

Source: Nordigen

Why consumers love open banking payments

Open banking payments appeal to consumers because the ability to pay from their bank account address their top concerns and needs around payments.

- Easy. Payments are transferred immediately once strong customer authentication is given, without the need to type card details. It takes only a few seconds to confirm the payment with passcode, face authentication or fingerprint.

- Safe. Making online payments using strong customer authentication feels safer than passing on card details since the possibility of someone getting those details is eliminated.

- Cheaper. Payment transaction costs are much lower in an open banking ecosystem because payments don't need to be routed through intermediary banks charging commission.

- Faster. When a customer utilises instant payment capabilities, open banking funds are transferred immediately. Companies benefit from immediate cash flow and increased conversion rates while individuals like instant payment confirmations and faster withdraws and refunds.

Open Banking in Australia

Australia has generally lagged the UK and Europe in its uptake of open banking initiatives. But with the roll-out of PayTo in 2022, Australia is set to become a forerunner of open banking payments globally.

PayTo builds on Australia's existing fast payments platform, the New Payments Platform (NPP). NPP created 'PayID', a system that allows users to pay others using an alternative alias to a BSB, for example an email address, ABN or mobile phone number.

PayTo goes one step further than NPP by allowing for preauthorisation of one-off or recurring payments. Importantly, PayTo bridges the gap from clunky multi-day bank transfers to seamless merchant-direct payments. It lays the groundwork for open payments to be launched under the Consumer Data Rights (CDR), a centralised body that will connect all the pieces of payments and data under a single authority. The CDR is the Australian equivalent of the PSD in Europe.

Importantly, though, PayTo is not goverend by CDR rules, so it is limited in its data sharing scope. While CDR rules are being finalised in a sector-by-sector roll out, PayTo has laid a solid foundation upon which open banking can be successful in Australia.